There are three little words that affect all of us in one way or another. They are “cost of living,” and they’re almost always followed by “is on the rise.” So, we have two options: work harder, longer hours to earn more money, or find ways to cut back and spend less (learn more about what it takes to be rich vs. wealthy – you’ll be surprised at the difference, it’s not money!).

Those of us that aren’t willing to clock more hours at the office just to keep up with the Joneses are willing to learn how to live on the cheap, while still feeling rich. Here are 15 cheap living tips:

1. Make Extra Money Doing Things You Already Do

A side hustle is a great way to beef up your income, and the good news is that you can earn extra money doing things you already do. Swagbucks pays out gift cards for things like shopping online, watching videos and discovering deals and promo codes. And, Survey Junkie will pay you just to answer questions about yourself and your life. Find something that pays money for little effort that feels like a good fit for you and get to hustlin’.

Click here to start making extra money with Swagbucks ($5 Signup bonus)

Click here to start making extra money with Survey Junkie

2. Automatically Save Money on Your Subscriptions

Subscriptions are sneaky little suckers. Music & video streaming services, apps, and add-ons add up. They’re usually for small amounts and automatically withdrawn from your checking account every month, so you barely notice it. But, think of it this way–ten monthly subscriptions that cost $10 on average add up to $100. $10 may not be a lot, but I think we can all agree that $100 IS A LOT.

Trim is a free app that negotiates your monthly bills for you. Trim works with companies like Charter, Time Warner, and Comcast to lower your bills so that you’re not paying more than you should be.

Additionally, when you use Trim and discover that there are subscriptions you’re paying for and not getting your money’s worth, you can cancel them with the push of a button (no having to call the company and sit through an hour long sales spiel begging you to stay…) Download the free Trim app here and start saving money on your monthly subscriptions.

3. Create a Meal Plan for the Week

Elaborate meals with tons of ingredients are some of the biggest money suckers out there. Even worse than that is not meal planning at all and then spending a ton of money at the drive-through or dining out at a restaurant every night.

Fortunately, with services like Dinnerly, you can eat restaurant quality meals that you prepare at home for a fraction of the price. Dinnerly is a meal delivery kit service, but unlike some which can cost over $500/week, Dinnerly is the cheapest meal delivery kit in the United States. All Dinnerly meals cost just $4.99 per serving, which is less than half what you’d expect to pay at a restaurant.

If you want an even cheaper meal plan service, then $5 Meal Plan is my #1 recommendation. $5 Meal Plan isn’t a meal delivery kit, they’re a meal planning service. Every week they will email you a full meal plan, including a grocery list. All of the meals are simple to make, family-friendly and cost just a few dollars or less per serving. $5 Meal Plan costs just $5 per month, and you’ll receive a full meal plan every week. Click here to try out $5 Meal Plan for free for 14 days.

You also may want to check out these dirt cheap meals and make your own meal plans!

4. Bank Online (and get a $25 bonus)

If you’re paying fees for your banking services, you’re doing it wrong. Most major banks, like Capital One, offer fee-free accounts when you utilize direct deposit and bank online. Some banks will even pay you a bonus for opening up an account.

Capital One is one of those banks that pays you a bonus, and the online bank that I’ve been using for years. When you open a free account with Capital One with an opening deposit of $250, Capital One will give you a bonus $25. Additionally, Capital One pays a 1% interest rate on savings accounts, which is substantially more than the average bank. That means you’ll be earning interest on the balance of your savings. Click here to join Capital One and claim your $25 bonus.

5. Stop Paying for Cable

The days of paying hundreds or thousands of dollars a year for a million cable channels that you only watch ten of are long gone. Without streaming services and devices like the Amazon Fire Stick, we now can be much more discerning about our viewing.

Choose a service that has most of the shows you like and subscribe. Not sure which platform would best meet your needs? Most of them offer a free trial so that you can get a feel before making a decision.

Pro tip – if you have Amazon Prime, did you know that you have free access to thousands of TV shows and movies? Don’t have an Amazon Prime account yet? Click here for a free 30-day trial.

6. Shop at Online Thrift Stores

Spending less does not mean depriving yourself of beautiful, stylish clothing. I’ve been shopping at ThredUp for years now, and I’m always finding stylish clothes at a fraction of the price.

ThredUp has clothes, shoes, accessories and jewelry for women, men and children. Recently, I bought a cute Ralph Lauren hoodie for my son for $4 (pictured below.) People always comment on how nicely dressed my son is, but I actually never pay full price for any of his clothes – he grows out of them way too fast! I buy almost everything from ThredUp, the clearance section at TJ Maxx or gently used at my local thrift stores.

Want $10 to spend at ThredUp? Click here to sign up for free and you’ll get a bonus $10 to spend!

Speaking of thrift stores – there are thrift stores in almost of every community that have high-end, lightly worn clothing at a fraction of the retail price. And, an added bonus is that you’ll start discovering brands and styles that you wouldn’t even have known you’d like if you stuck to the same old retail stores you where you always shop.

7. Hold Out for Sales

Sales and promotions are part of the circle of life, and there’s no reason to pay full price for just about anything these days. Whether it’s a new car or a fresh pair of sneakers, hold out for a sale. It will come. You might ask a salesperson or store associate when they expect the item to go on sale next. Or sign up for email promotions so that you’re ready to strike when the iron is hot.

8. Get Refunds When the Price Drops

Sometimes even when you’ve held out for a sale, the price will drop even further. Frustrating, right? You might not know this, but a lot of stores will refund you the difference if that happens. But do you really have the time to be tracking everything you buy online to make sure it doesn’t drop in price after you’ve bought it? Well, there’s a free app called Paribus that will do that for you.

You simply link Paribus up to your inbox and it automatically scans your receipts. Paribus will then keep check on the price of the items you’ve purchased online, and if the price drops they will work on your behalf to get a refund of the difference.

Click here to read my full review on Paribus.

9. Take Your Workout Outside (or Inside)

Of course, exercise is a good thing, by why do we pay gyms hundreds of dollars every year to do activities that we could do outside or indoors for free? Bike-riding, walking, running, jumping, and climbing stairs can all be done at no cost to you.

“But I love the fitness classes,” you say. If you really want to embrace cheap living, how about downloading the Aaptiv app and accessing the hundreds of instructor-led workouts through your headphones, at less than the cost of a single gym workout class? You could then just purchase a punch-card at your local gym if you wanted to attend the occasional in-person workout.

Click here for a free 30-day trial of Aaptiv.

10. Plan to Eat Out (And Earn $10-$50)

Setting an “eat out” night is an excellent way to save money without depriving yourself. Just think, $10 at a fast food drive through a few times a week can add up to $80 a month. Why not set that money aside, spend $50 once a month at a nice restaurant, and earn $10-$50 in Amazon or Lyft credit when you eat a restaurant featured on Seated.

You may also want to try some of these cheap date ideas that are fun without spending tons of money eating out.

Seated is a free app that pays you in Amazon or Lyft credit when you dine at selected restaurants. Just scroll through the app to find a restaurant that looks delicious. Make your reservation, enjoy your meal and then upload a photo of your receipt. You’ll receive a percentage of your total bill back in rewards.

Use my promo code ASHLI5 and you’ll receive a $5 bonus when you join Seated here.

11. Save Money On Online Shopping

There are many coupons floating around on the internet that you’ll never know about unless you search before you buy. You can Google the name of the store you’re planning to shop at and the word “coupon,” and you’ll be able to find out if there are any discounts out there.

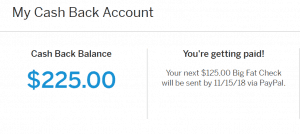

When it comes to online shopping, the best way to save money is to join Ebates. You’ll not only save money with the exclusive coupon codes on Ebates, you’ll also earn a percentage of your purchase price in cash back, paid via PayPal or check. As you can see from the screenshot below, I currently have $225 in my cash back account. Click here to join Ebates and get a bonus $10.

12. Earn Cash Back On Gas

Cars are expensive to run, with the biggest expense being gas. If it’s possible where you live, you can save money by biking or walking when you can, which has the added benefits of improving your health and the health of the planet.

However, for most of us, it’s not possible to walk or bike everywhere. One of my favorite ways to save money on gas is by earning cash back with the Trunow app. When you download the Trunow app on your smartphone, it’ll show the best prices for gas near you. After you’ve bought your gas, snap a photo of your receipt and you’ll get 1% cash back. Click here to download Trunow.

13. Get a Designer Coffee Kit

A $5 frappe 5 times a week can cost you $100 a month, without you noticing it slipping out of your checking account. Make your coffee at home and fatten up your savings account by stowing away that $100. By the end of the year, you’ll have $1,200 saved up in latte money alone.

“But at-home coffee doesn’t compare to “designer” coffee”, you might say. That might be true, but not if you use this designer coffee kit that I use. My husband used to have an expensive coffee addiction, so I bought this kit for our home. It works out to just over $1 per coffee, which saves us almost $1000/year. Get your designer coffee kit here.

14. Unsubscribe From Emails

If you’re like most people, your inbox is inundated with sales, special offers, and encouraging messages to “act now” by the time you wake up in the morning. The thing is, acting on these special offers may help us save money on an item, but we may not have spent any money on that same item if we didn’t know about that sale. Unless you’re holding out for a sale to buy a specific item from a website, go ahead and remove temptation from your inbox by clicking “unsubscribe.”

15. Be Careful on Social Media

Instagram, Facebook, and Pinterest all have an uncanny ability to make us WANT. Whether we see advertisements from our favorite stores or a pair of gorgeous boots on an “influencer” by the time we finish a fifteen-minute scroll session we usually have a 15-item wishlist. Become informed on the correlation between social media and your spending so that you know you’re intentional when you click that “buy now” button.

Hopefully, there are a few cheap living tips here that you can embrace to save a few bucks without really feeling it. With little strategic maneuvering, it is possible to figure out how to live on the cheap and live well.

Hi I’m Ana. I’m all about trying to live the best life you can. This blog is all about working to become physically healthy, mentally healthy and financially free! There lots of DIY tips, personal finance tips and just general tips on how to live the best life.